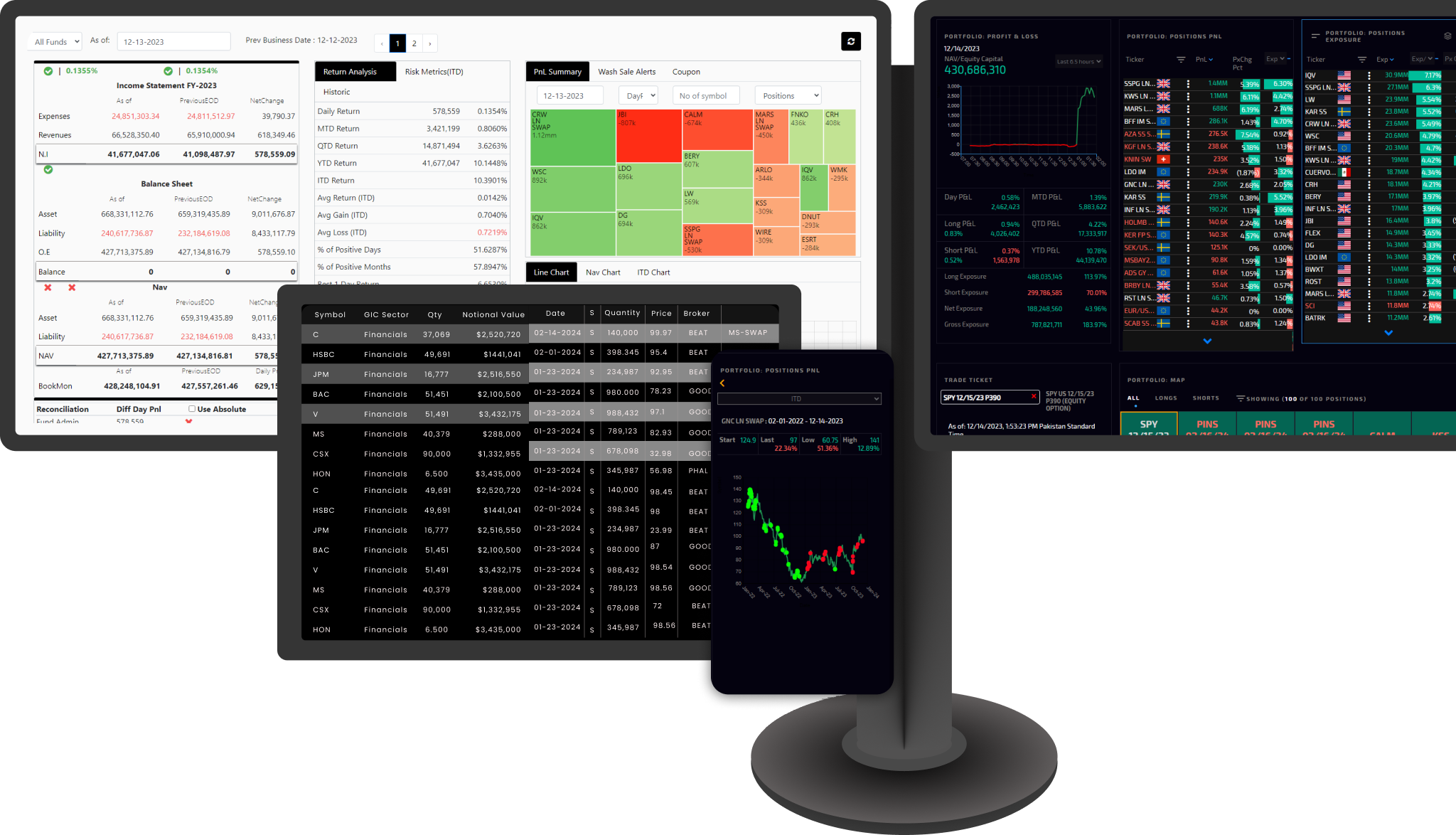

Empower Your Investment Strategy with Precision and Ease

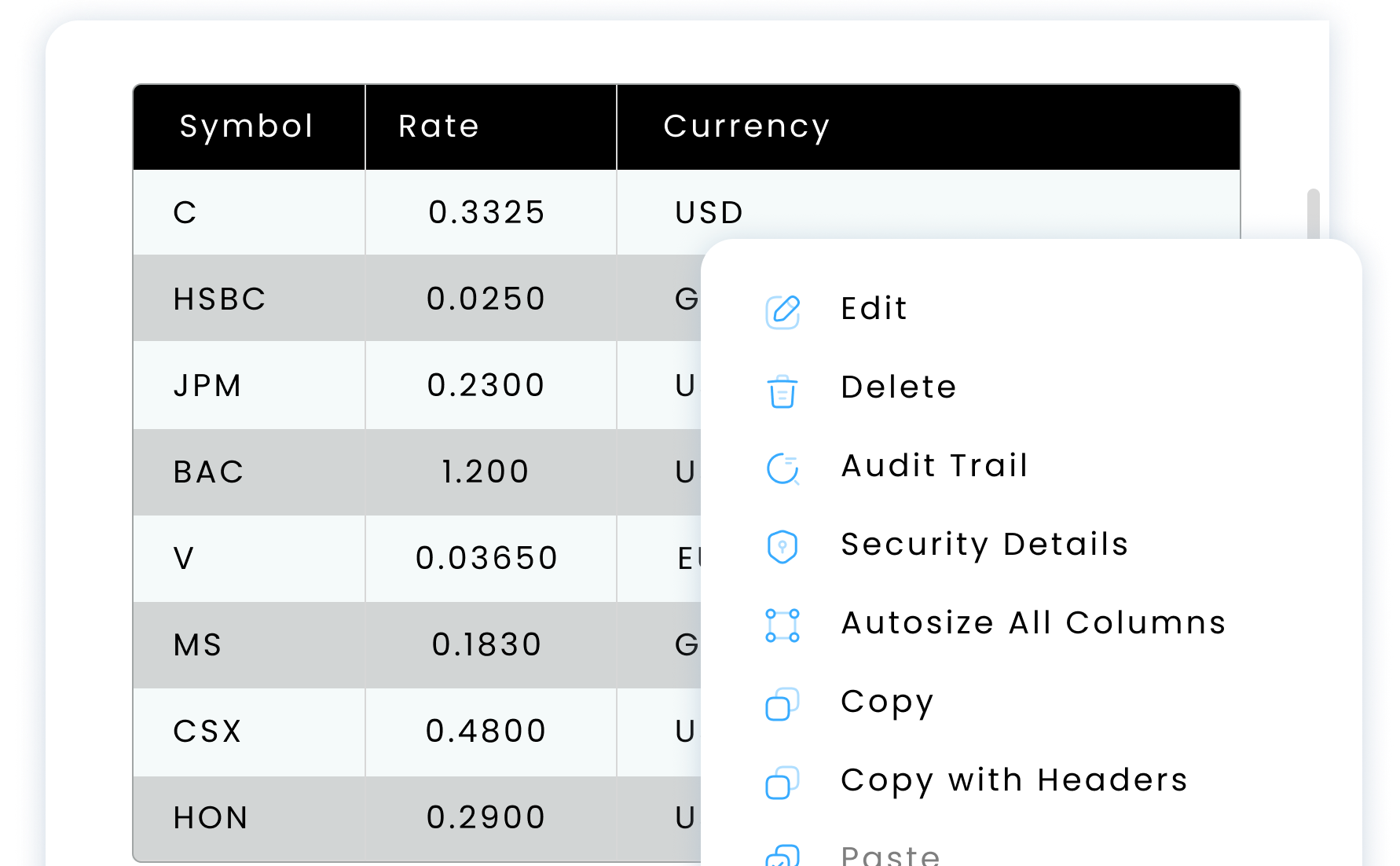

Experience financial efficiency with Sharkfin's accounting module, featuring a robust double-entry general ledger. It automates debits and credits, maintaining a complete, real-time Account Book of Record (ABOR).